Cash Balance Plans Explained - 2024

With increasing rates of 17% (1), Cash Balance plans are the fastest-growing part of the pension universe. Cash balance plans made up 42% of all defined benefit plans in 2018 (2), up from 2.9% in 2001, and this market continues to see double digit annual growth each year, primarily for small to mid-size companies (defined as those with less than 100 employees) compared to relatively flat growth in other qualified plans.

So what is a Cash Balance Plan? A Cash Balance plan is a type of defined benefit (DB) plan (traditional pension plan) that resembles a defined contribution (DC) plan (profit sharing and 401(k) plans). Each participant is entitled to a guaranteed benefit that is promised in the form of an account balance. The "account" is credited each year with:

a) Pay Credits - a certain annual contribution (usually some percent of pay or flat dollars amount per employee); and

b) Interest Credits - a certain generally fixed percent for the year.

For example, a Cash Balance plan might promise a Pay Credit that is 3% of pay each year and an Interest Credit that is a 4% yield on the account balance.

ADVANTAGES OF A CASH BALANCE PLAN

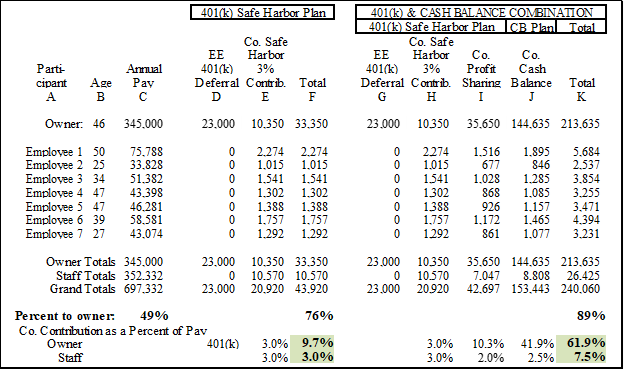

1) Higher Deductions – Cash Balance (CB) plans can sometimes have a higher deduction for older, higher-paid participants, when compared to DC plans.

2) Age neutral results - The benefit can be structured so that the account balance ignores age (unlike traditional pension plans). However, age is used to document there is no discrimination between Highly Compensated Employees (HCEs) and Non-Highly Compensated Employees (NHCEs).

3) Flexibility in design – There is flexibility in designing different benefits for different people. For example, a plan could give owners a higher Pay Credit than it gives to non-owners.

4) Flexibility in contribution – Most of these plans are valued in such a way that there is a contribution range each year, from the minimum required contribution up to the maximum deductible contribution.

5) Investment gains – A Cash Balance plan promises a consistent annual positive gain on the “account” owned by the participant. This can be an attractive feature when communicating to employees.

6) Pooled investments – Since the participants do not control investment choices in these plans, the management of investments is simpler than in typical 401(k) plans.

7) Reduction in other taxes – For most closely held firms, an increase in contributions for owners is often offset by a reduction in taxable compensation, thus deferring Federal and state income taxes, and totally eliminating (now and later) FICA taxes, Medicare taxes, and local occupational taxes.

8) Creditor protection is usually better for qualified plans, when compared to taxable accounts. In other words, the owner of a company can contribute to both regular taxable accounts and qualified retirement plans. However, the dollars in the qualified plans (e.g, 401(k) plans, CB plans, etc.) are more likely to be protected by the courts and labeled as assets that can’t be attached by creditors, due to federal laws.

DISADVANTAGES OF A CASH BALANCE PLAN

1) Special rules - A Cash Balance plan (like all DB plans) is still subject to many DB rules, including, among other things (a) Minimum funding requirements; (b) Code Section 415 DB limits (which limit the annual payout from the plan when the account balance is converted to a pension at retirement age); and (c) Code Section 401(a)(26), which requires that the CB plan cover at least 40% of all the employees (or 50 employees, if less) who have met the plan’s age / service requirements.

2) Duplications – When covering non-owners, CB plans are almost always adopted in conjunction with 401(k) plans, thus requiring two sets of (a) plan documents; (b) trust funds; (c) annual government filings of Form 5500; and (d) audits for plans covering more than 100 participants.

3) PBGC premiums - DB plans (including Cash Balance plans) must pay PBGC premiums each year – $96 per participant, plus an additional $52 per $1,000 of unfunded vested benefits (UVB), if applicable for 2023. However, CB plans sponsored by certain professionals covering less than 25 participants are exempt from the PBGC premiums. Premiums are scheduled to increase for inflation. For 2024, premiums will be:

Plan Years Beginning in Per Participant Variable Rate Premium

Flat Rate Per $1,000 in UVB

2024 $101 $52

4) Unfunded Liabilities - Investment losses can increase unfunded liabilities since the employer is guaranteeing the Interest Credit.

ILLUSTRATION

(1) Cash Balance Design Research Report 2020 https://www.cashbalancedesign.com/resources/research-report/

(2) Future Plan by Ascensus 2020 National Cash Balance Research Report https://assets.futureplan.com/futureplan-assets/National-Cash-Balance-Research-Reports-2020-FuturePlan.pdf