4 Small Employer Plan Credits

Notice 2024-2 and/or Notice 2020-68 included guidance for the four available tax credits for small employers. The tax credits are for the following:

- Startup credit for adoption of a new defined contribution plan,

- Employer contribution credit,

- Credit for adding eligible automatic contribution arrangement, and

- Credit for hiring an employee who has a spouse in the military.

The tax credits will be included on Tax Form 8881. The credits are available for a stated number of years and are subject to dollar limits. The credits are not refundable which means that governmental and tax-exempt organizations are not eligible.

The tax credits are available to eligible employers as described in section 408(p)(2)(C)(i). Eligible employer means an employer which had no more than 100 employees who received at least $5,000 of compensation from the employer in the preceding year. This includes all employees of any related companies, union employees, nonresident aliens, leased employees, and self-employed individuals.

If the employer goes over the 100-employee threshold, they will no longer be an eligible employer. Thankfully, we are provided with a 2-year grace period that allows an ineligible employer to be treated as an eligible employer for the 2 years following the last year in which the employer was an eligible employer. For example, Leisha’s Consulting Company 401(k) Plan started in 2020 and had 95 employees in 2024. In 2025, the number of employees increased to 135. The consulting company would be considered an eligible employer for 2025 and 2026.

If the employer becomes ineligible due to an acquisition, merger, or disposition, this would not be the case. If Leisha’s Consulting Company acquires a company in 2024 that put them over the 100-employee threshold, then it will no longer be an eligible employer for 2025.

STARTUP CREDIT

The startup credit for adopting a new defined contribution plan is 50% of the qualified startup costs paid or incurred, but limited to the greater of –

(a) $500, or

(b) The lesser of –

(i) $250 for each employee who is not a Highly Compensated Employee and who is eligible to participate in the plan, or

(ii) $5,000.

The credit was increased by SECURE 2.0 to 100% of the qualified startup costs if the employer has no more than 50 eligible employees for tax years beginning after 2022.

An employer who establishes a new plan is NOT eligible for the credit if that employer (or any member of any control group including the employer or a predecessor of either) maintained another qualified plan (including a SIMPLE or a SEP) for substantially the same employees during the 3-taxable year period immediately preceding the first taxable year for which the credit would otherwise be applicable. All eligible employer plans are treated as one plan.

Qualified startup costs mean ordinary and necessary expenses paid or incurred in connection with the establishment or administration of the plan or retirement-related education provided to the employees of the plan.

The plan must cover at least 1 Non-Highly Compensated Employee (meaning that a sole proprietor is not eligible for the credit).

The first year for the credit can be the first year that the plan is effective or the taxable year preceding the first year the plan is effective (since there might be billable startup costs for the preceding year for consulting services, etc.). The employer cannot take the credit and a tax deduction for the same startup costs.

EMPLOYER CONTRIBUTION CREDIT

The employer contribution credit applies to tax years beginning after 2022 and is separate from the credit for startup costs. It is available for eligible employers. The credit is the lesser of the employer contribution (match and nonelective) or $1,000. The maximum credit is based on employees in the prior tax year. If in the prior year the company had less than 50 employees, they will receive 100% of the tax credit. The credit will be reduced by 2% for each employee over 50 employees. There is no credit available if you have more than 100 employees as defined previously for five years with the first year the plan was effective.

It does not require that the plan have Non-Highly Compensated Employees but compensation is limited to less than $100,000 (indexed) of FICA wages. (Note that sole proprietors and partners do not have FICA wages so no credit is available). Related employers are treated as one employer. It is not available if the employer, related employer, or predecessor established or maintained a defined contribution plan for substantially the same employees as plan qualifying for credit. This credit is limited to defined contribution plans only.

For example: Leisha’s Consulting Company has 40 employees that meet the requirement. The actual match was $105,000 for 2023. The tax credit would be $40,000 (40 * $1,000).

You also cannot claim a deduction for the credit amount. So, the deduction is for total employer contribution less credit.

CREDIT FOR ADDING ELIGIBLE AUTOMATIC CONTRIBUTION ARRANGEMENT (EACA)

The SECURE 2.0 Act did not make any changes to the credit for adding auto enrollment to a plan after 2019. The rules remain that eligible employers can receive a tax credit of $500 for each year of the 3-taxable year period beginning with the first taxable year for which the employer includes an EACA. The plan must continue to be an EACA plan to take the credit for years 2 and 3. If a plan spins off the original plan, then the 3 years would continue with the new plan as well.

The eligible automatic contribution arrangement is an arrangement under which the participant is auto enrolled in the plan at some uniform percentage of compensation unless he specifically opts out or elects a different percentage and under which the participant receives an automatic enrollment notice. Plans that are eligible for the credit include 401(k) plans and SIMPLEs. 403(b) plans and 457(b) plans are NOT eligible for the credit. The credit is available for auto enrollment added to a new plan or to an existing plan. Unlike the startup credit, the credit for adding auto enrollment is not tied to plan expenses and there is no requirement to have non-owner participants in the plan. The credit for adding auto enrollment is in addition to the startup credit.

MILITARY SPOUSE CREDIT

If an eligible small employer hires an employee who has a spouse in the military and that employee has a military spouse that is considered a Non-Highly Compensated Employee for tax years after 12/20/2022, they will be eligible for a tax credit of $200 plus the lesser of the employer contribution or $300. The military spouse must be eligible to participate in the defined contribution plan no later than 2 months after hire and receive the same employer contribution as any other participant with 2 years of service. The contribution must be 100% vested. The credit is calculated separately for each military spouse. The tax credit applies to the years before 2023 and can count towards the three-year requirement even though the credit was not available. For example, hired in 2021, the credit is only available for the 2023 tax year that the spouse enters the plan and the following two years assuming they are still a participant in the plan.

Example:

Leisha’s Consulting Company (eligible employer) hires Sharon who is a military spouse in 2023 and the company is an eligible small employer. Sharon was immediately entered into the plan and received a 3% Safe Harbor nonelective of $1,500. The military spouse credit would be $500 ($200 + $300).

These tax credits are based on the company’s individual facts and circumstances. The company’s tax advisor will make the determination of what credits are allowed. Do not hesitate to contact RMS with any questions or concerns.

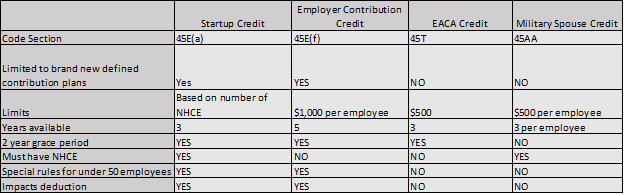

COMPARISON EMPLOYER PLAN CREDITS